Tokenized assets are the same thing as crypto, right?

By: Tom Menner, Chief Technology Officer, SBI Digital Markets

This is a really common misconception, not only for people who are new to the topic, but also for many that are already knowledgeable about various areas within the ever-growing digital assets space.

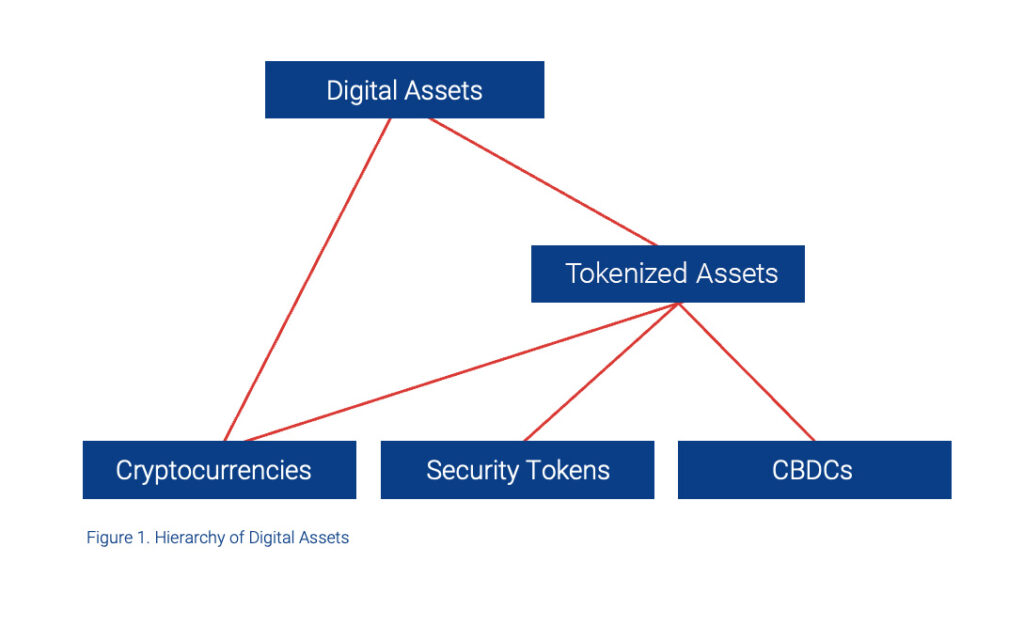

Asset tokenization is the process by which an issuer creates digital tokens on a distributed ledger technology (DLT) or blockchain that represent some asset class of value, typically a physical or “real world” asset but it can also be digital (as we will see in a moment). These tokenized assets are in turn a subclass of a broader category called “digital assets,” with the other subclass being cryptocurrencies.

Cryptocurrencies are digital assets for which their value is derived within their own ecosystem, as it does not reference any asset or value outside of itself. Bitcoin, for example, does not refer to any asset outside of Bitcoin, and its value is determined by the marketplace, which is by what people believe the value and utility of Bitcoin to be.

Other cryptocurrencies such as Ether, which is the coin used in Ethereum, also has its value tied to its own ecosystem, but it also provides utility in that it is used as an incentive to execute smart contracts on Ethereum. So the value of Ether is determined partially by the marketplace, and partially by its use as an incentive within the Ethereum ecosystem.

These smart contracts are important because this is where the next level of digital assets comes in, namely tokenized assets. Using smart contracts and a tokenization standard (such as ERC-20 or ERC-721), one can define tokens on platforms such as Ethereum that represent a claim on other assets, for example a stock, a bond, gold, real estate, artwork, wine bottles – even other cryptocurrencies. And note that this is not particular to Ethereum, as in general most DLT platforms (including private permissioned) can represent tokenized asset classes.

This technology was responsible for Initial Coin Offerings (ICOs) prior to 2020, and in recent years has seen cryptocurrencies and Non-Fungible Tokens (NFTs) emerge as popular but highly speculative investment vehicles. But the more traditional financial services such as banking, payments and capital markets saw that this technology could be useful for more prosaic business concerns, such as increasing capital liquidity and velocity, and reducing risk and settlement times.

From a capital markets perspective, for example, we can use tokenization to fractionalize an expensive asset such as a bond or real estate and make it a more accessible investment. Because the Tokenized asset is on a DLT it can be moved and sold through new distribution channels and settled near-instantaneously on a shared ledger. Bank reserves can be tokenized as stablecoins which in turn can be used for settlement; and collections of tokenized assets can be assembled as baskets of collateral – just to cite a few examples. But in each of these cases, the token is digitally representing some capital asset.

And coming back to an earlier point, a token can even represent a cryptocurrency. For example, the token could represent a derivative on the price of Bitcoin, which in turn is packaged into a structured product. Or it could simply be a way to represent trading of Bitcoin on a different platform (such as a private permissioned DLT).

This quick overview leaves out discussion of other tokenized assets, such as utility tokens, equity tokens, NFTs, and Central Bank Digital Currencies (CBDCs). We’ll save that for another day.

By: Tom Menner, Chief Technology Officer, SBI Digital Markets